Market Outlook & Buying Strategy

I. Recommendation

Proceed with immediate procurement of 40 HC CW units at Los Angeles / Long Beach, where pricing remains competitive and depot liquidity strong. Secondary acquisitions in Oakland and Seattle are advisable only when delivery geography justifies higher freight or dray costs. The combination of firm freight indices and improved trade sentiment makes this week a practical entry point.

II. Market Summary

Ocean freight rates continued to firm modestly through early November. Drewry’s WCI rose to US $1,822 (+4 %), and Shanghai–Los Angeles spot rates hovered near US $2,440 / FEU. Freightos’ FBX composite index stabilized around US $1,870, confirming that carriers are sustaining higher base levels into Q4. In parallel, U.S. ISM Manufacturing PMI (52.2) signaled expanding demand, while China’s Caixin PMI (49.0) pointed to controlled contraction – a combination consistent with stable trade flows.

The APEC summit’s U.S.–China outcome reduced tariff escalation risks and improved forward visibility for logistics. Supply-chain managers now report greater confidence in Q1 2026 planning, particularly for SOC equipment rotation.

III. Analytical Insights

- Geopolitical easing reduces risk premium. The Trump–Xi meeting restored confidence in bilateral trade, leading to a pullback in risk-driven container price premia and stabilizing asset valuations.

- Freight firmness supports SOC values. With spot rates holding steady, own-container purchases remain attractive for operators seeking cost control against variable COC charges.

- Seasonal tailwinds remain intact. Q4 retail imports and early Lunar New Year shipments continue to drive equipment turns and limit depot oversupply.

IV. Outlook (4–6 Weeks)

Freight indices are expected to stay sideways-to-up through mid-December as pre-LNY bookings build. 40 HC CW units on the West Coast may gain US $50–150 per unit if current momentum persists. 20 GP CW units should remain stable with selective firmness in active depots. For One-Trip 40 HC, cosmetic premium demand is expected to remain steady.

**Action Plan:** Secure allocations this week at LAX/LB. Reassess after next Drewry index print and U.S. CPI release. If freight strength continues, raise bid ceilings accordingly.

Final Recommendation

Act immediately to lock 40 HC CW inventory in Los Angeles / Long Beach while pricing remains favorable. The combination of steady freight indices and reduced geopolitical volatility offers a clear short-term buy signal before potential tightening in December. Oakland and Seattle should serve only as secondary pickup points based on delivery needs.

Week 45 Market Update: Stable Freight and Geopolitical Relief Support 40HC CW ProcurementData Sources: Drewry WCI (Oct 30 2025); Freightos FBX; APEC Summit Statements (AP News, Washington Post, TIME); ISM & Caixin PMI (Oct 2025). All data verified within 48 hours of publication for accuracy and recency.

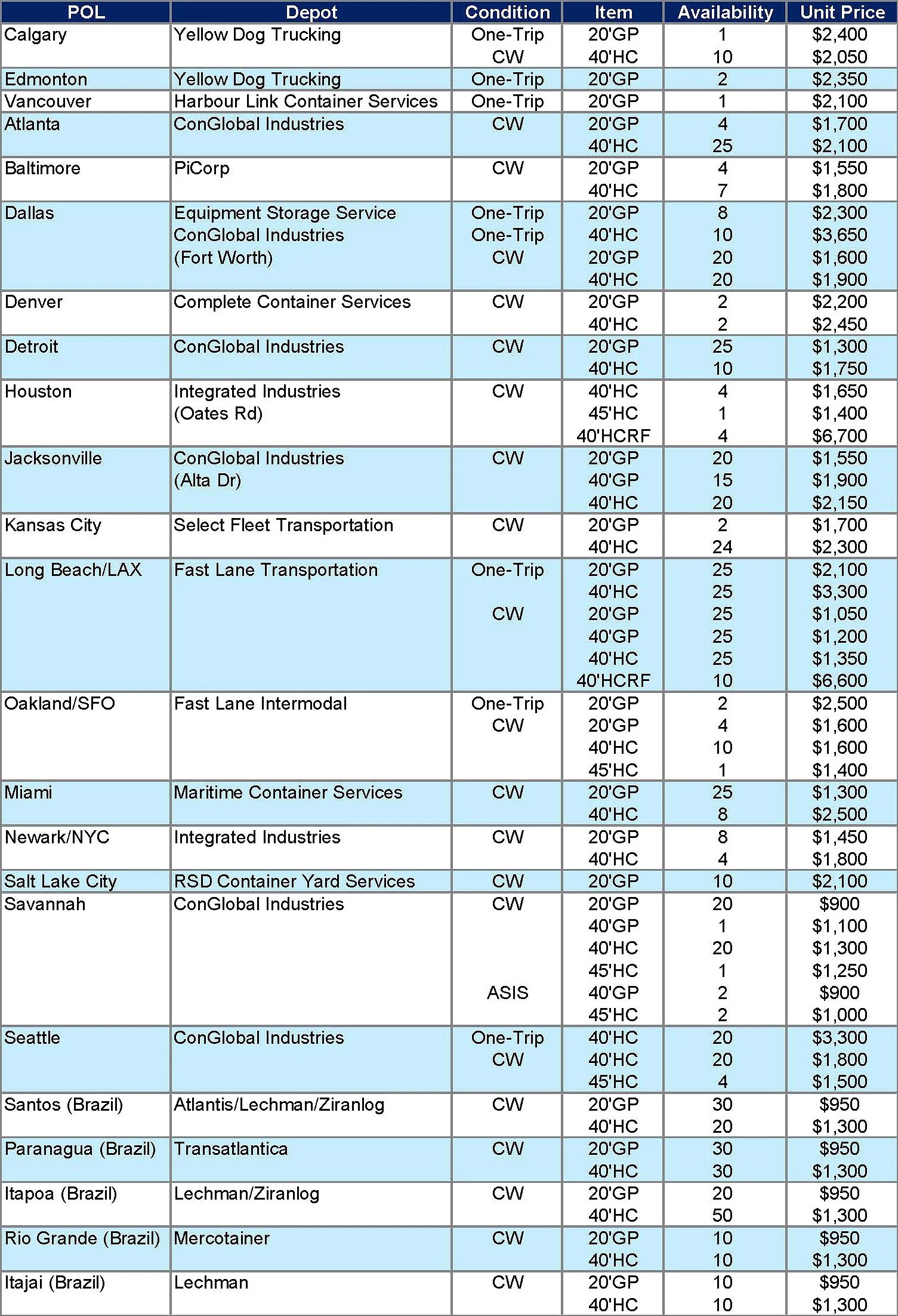

* Muwon USA’s Sales Container Inventory as of November 2, 2025