Market Outlook & Buying Strategy

Week 44, 2025

Executive Summary

Container availability across North America continues to tighten as the industry enters the final phase of 2025. Freight rates on major Trans-Pacific routes have climbed over 5% month-on-month, while inland depots experience delayed turnover due to pre-holiday logistics congestion. According to Drewry (Week 43, 2025), Asia–U.S. East Coast rates remain 22% above the five-year average, reflecting persistent structural tightness. Muwon USA recommends immediate procurement of 40HC Cargo Worthy (CW) and One-Trip units in Dallas, Long Beach, and Seattle before year-end, ahead of the expected Q1 2026 price escalation.

I. Recommendation

We advise immediate acquisition of 40HC CW units in Dallas ($1,850), Long Beach ($1,350), and Seattle ($1,800) during November. These prices remain below both regional and historical averages and represent the last window before Q1 cost inflation. With current freight market trends and depot-level shortages, delaying purchases into December or early 2026 may result in an 8–12% increase in container procurement costs.

II. Market Summary (Late October 2025 Overview)

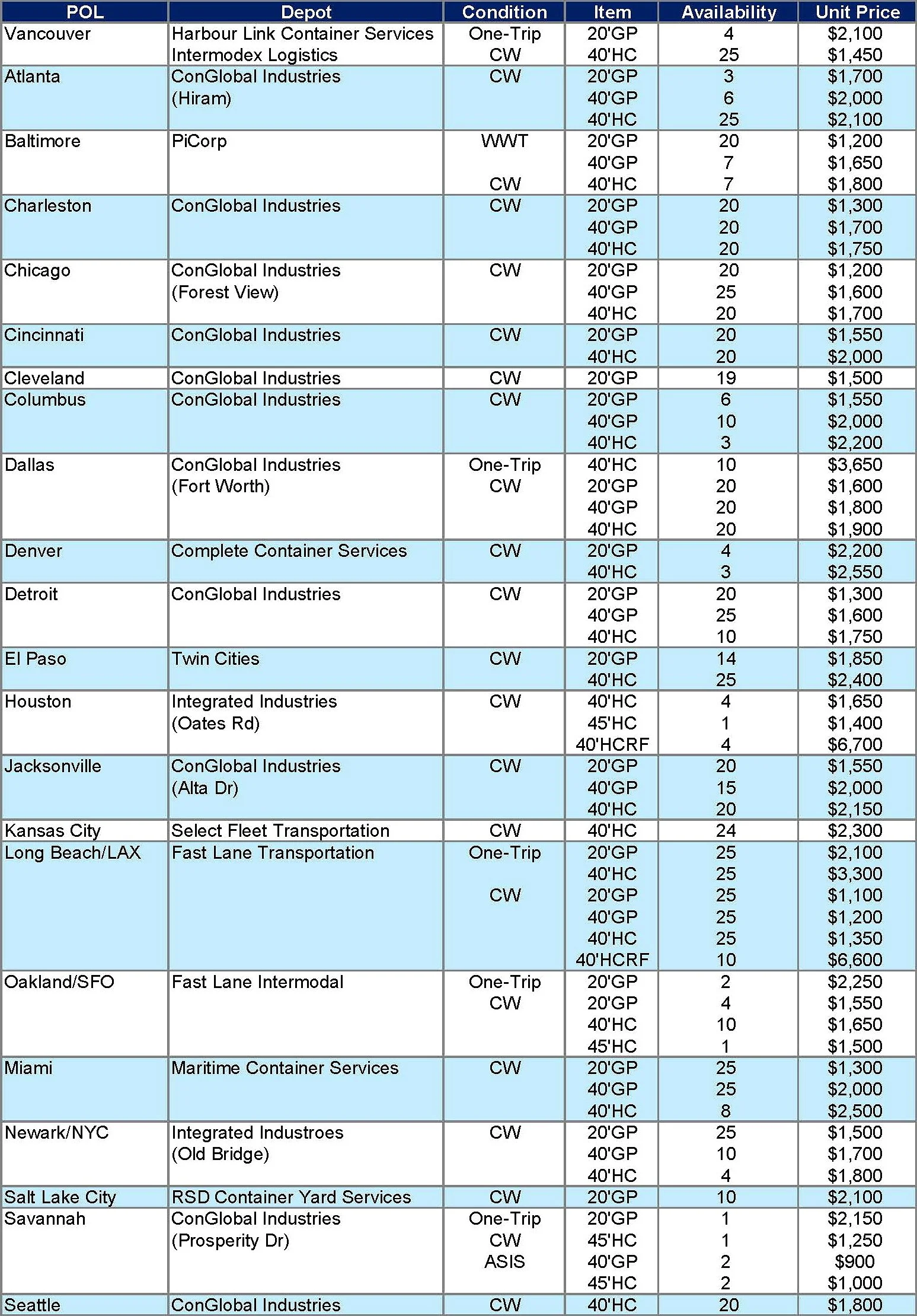

From Muwon USA’s October 27 inventory update:

- Dallas (ConGlobal Industries, Fort Worth): 40HC CW units at $1,850, with 20 units available — below the U.S. average of $1,950.

- Long Beach/LAX (Fast Lane Transportation): 40HC CW at $1,350, One-Trip units at $3,300 — the widest price gap among coastal depots.

- Seattle (ConGlobal Industries): 40HC CW at $1,800, steady pricing but tightening availability.

- Houston: 40HC CW at $1,650; 40HCRF units remain elevated at $6,700, driven by reefer demand.

- Atlanta, Jacksonville, and Columbus: Mid-range CW pricing ($1,700–$2,200) offers balanced options for inland buyers.

Across all markets, CW (used) units trade in the $1,500–$2,200 range, while One-Trip containers remain between $2,100–$3,600, depending on location and demand intensity.

III. Analytical Insights

1. Freight Rate Resilience and Prolonged Tightness

According to Drewry (Week 43, 2025), Asia–U.S. West Coast rates average $3,650/FEU, up 4.1% from September. Shipping lines continue to retain equipment longer for owned operations (COC), limiting secondary market flow for SOC buyers. This structural constraint is expected to sustain limited CW availability through Q1 2026, particularly in Western and Southern U.S. hubs.

2. Depot Congestion and Inventory Flow Challenges

Depot turnaround cycles in Dallas, Chicago, and Columbus have extended by 10–15% since August due to year-end congestion. Reduced repositioning activity means less fresh inventory entering the retail and wholesale markets, reinforcing price firmness. This dynamic underscores the importance of locking in available stock now, rather than waiting for uncertain replenishment in January.

3. Immediate Cost Advantage in Select Markets

Muwon USA’s depots in Dallas and Long Beach currently offer pricing 5–10% below the Q4 regional average, positioning them as optimal procurement points. Given projected Q1 cost inflation from both freight surcharges and inland handling rate adjustments, buyers securing inventory now effectively hedge against upcoming price escalations.

IV. Outlook & Strategic Recommendation

| Period | Key Drivers | Market Implications |

|---|---|---|

| Nov–Dec 2025 | Holiday logistics congestion, tight CW stock | Firm pricing; decreasing on-ground availability |

| Jan–Mar 2026 (Q1) | Restocking, elevated leasing utilization | 5–8% price appreciation; limited replenishment |

| Q2 2026 | Post–Chinese New Year correction | Partial normalization, but price floor remains solid |

Strategic Takeaway: With freight rates trending upward and depot congestion constraining supply, November presents the last major opportunity for cost-efficient container procurement. Muwon USA’s competitive pricing— particularly for 40HC CW units under $1,900—offers tangible value ahead of the Q1 surge. Immediate action ensures supply security, logistical flexibility, and price protection entering 2026.

Final Recommendation

Secure 40HC CW containers from Dallas, Long Beach, or Seattle before mid-November. Market fundamentals indicate tightening supply and upward momentum through Q1 2026. Acting now ensures both availability and cost efficiency while maintaining operational readiness for early 2026 demand.

* Container Sales Inventory as of Monday, October 27, 2025