Market Outlook & Buying Strategy

North America Container Market Update – Week 43, 2025: Economic Softness Unleashes a Strategic Buying Window

I. Recommendation

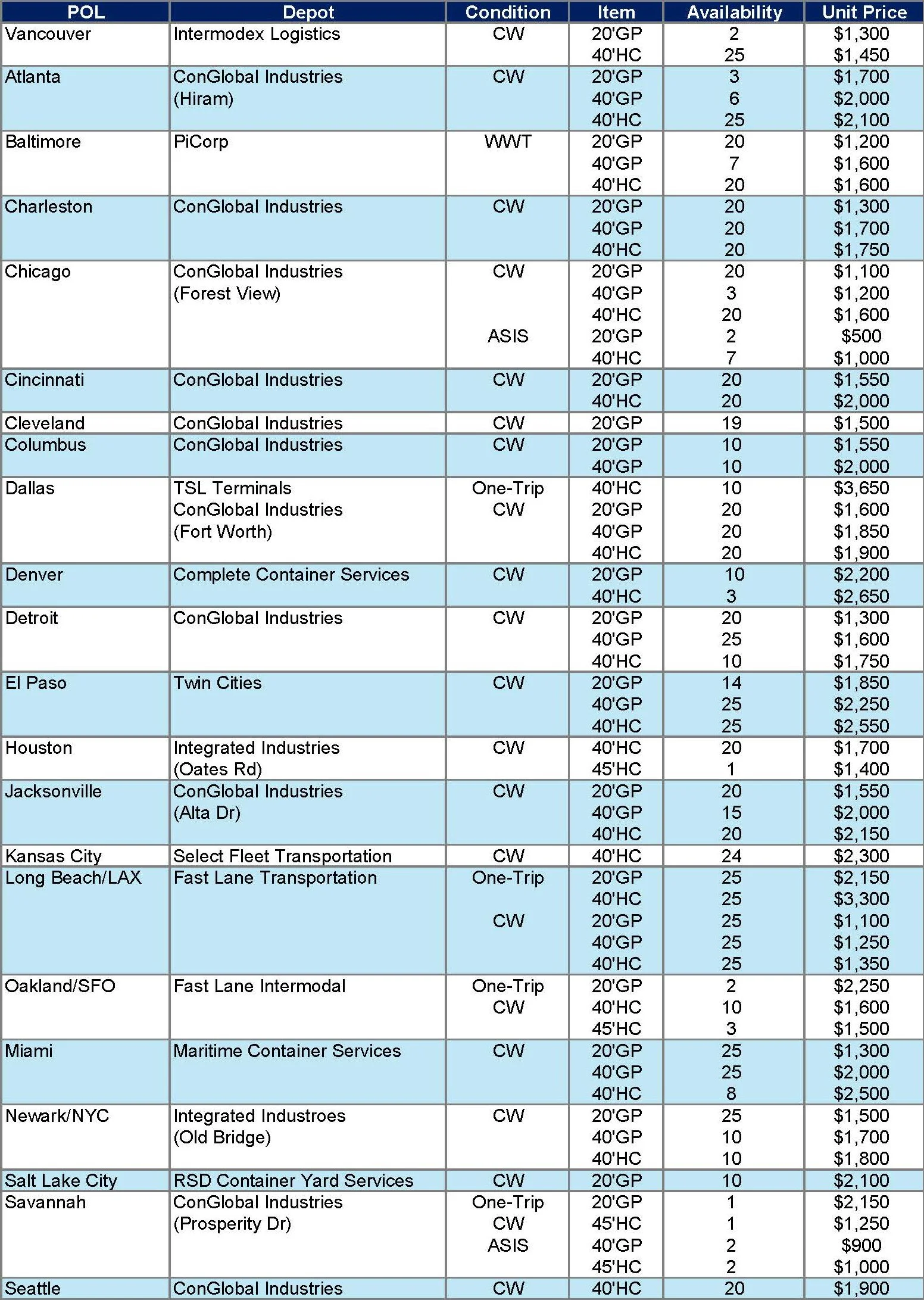

Secure container inventory immediately at gateway locations. Focus specifically on CW 20GP and CW 40HC units at Long Beach/LAX, Vancouver, Miami, and Newark/NYC while structural uncertainty keeps supply abundant and asset values near cycle lows. Delay introduces the risk of missed opportunity if policy or demand rebounds unexpectedly.

II. Market Summary

Freight Rate (COC/SOC) Conditions: According to Drewry’s World Container Index (WCI) published 16 October 2025, the composite index increased 2 % to US$1,687 per 40-ft container, after 17 consecutive weeks of decline. Spot rates from Shanghai to Los Angeles were ~US$2,195/40ft and to New York ~US$3,236/40ft.

Freight Rate Trend (Drewry WCI)

Import Volume & Demand (US): The National Retail Federation (NRF) & Hackett Associates forecast U.S. container‐import cargo levels in 2025 will end ≈ 5.6 % below 2024. Further, monthly import cargo volumes at major U.S. ports are expected to fall below 2 million TEU for the remainder of 2025.

U.S. Monthly Import Volumes (2025)

Macro & Geopolitical Backdrop: U.S. economic momentum remains weak — consumer spending and industrial production have come under pressure — while trade‐policy volatility (tariffs, retaliations) and global growth forecasts remain muted. These factors create caution among importers, reducing new equipment demand in the near term.

III. Analytical Insights

1. Supply-Demand Dynamics

U.S. importers, anticipating tariff escalation and elevated costs, accelerated shipments in the first half of 2025. This front-loading has resulted in weaker import demand in the latter half, which in turn increases container availability at gateway depots and reduces upward price pressure in the secondary market.

Logical consequence: When demand is deferred, supply builds or persists, giving buyers leverage.

2. Freight Cost Relation to Container Asset Prices

Freight rates (COC/SOC) remain subdued, lowering the effective “cost of repositioning” containers (via SOC one-ways) for buyers. At the same time, trade-market asset values (container sale prices) are catching up to the soft shipping environment. In other words: low freight rates + high equipment supply = attractive acquisition window for containers. The recent uptick in WCI to US$1,687 reflects a short-lived rebound; Drewry forecasts further weakening ahead. This suggests that secondary-market container values may have near-term floor but also that acting now captures value before any tightening.

3. Strategic Timing & Risk Mitigation

The coexistence of economic softness, tariff-induced import pull-forward, and geopolitical uncertainty creates a rare “buyer’s window” — one where prices are depressed not because the long-term value is broken, but because timing and policy have suppressed demand temporarily.

From Muwon USA’s vantage: our gateway stock of CW 20GP/40HC units is competitively priced (Long Beach ~US$1,100 for 20GP, US$1,350 for 40HC) and provides readiness for buyers to act now. If demand were to rebound (via tariff relief, fiscal stimulus, or shipping disruptions), container prices could rise sharply. Acting now hedges that risk.

IV. Outlook & Recommendation

Outlook for next 2-4 months:

- Freight rates may see modest gains via carrier sailings cuts or GRIs, but structural demand weakness in the U.S. and global economy will likely keep pressure on rates and equipment prices.

- Import volumes into U.S. ports are forecast to stay below normal for the remainder of 2025, lessening near-term procurement competition amongst end-users.

- Should macro policy pivot (e.g., rate cuts, fiscal stimulus) or logistical shocks occur (e.g., Red Sea disruption), container asset values will react upward—potentially quickly.

Recommendation summary: Given the current environment, it is logical to buy now — securing our CW gateway equipment ahead of a possible rebound. Delay increases the risk of losing the buying window, especially if supply tightens or repositioning costs rise. Ensure procurement of CW 20GP/40HC units at Long Beach/LAX, Vancouver, Miami, and Newark/NYC from our available inventory — this is a moment to act decisively.

Suggested Email Subject Line:

“Week 43 Insight: Secure Your CW 20GP/40HC Containers Now — Gateway Values at Strategic Low”

* Muwon USA’s New & Used Shipping Container Inventory as of October 20, 2025