U.S. Skid-Steer Loader Wholesale & Rental Market Outlook

As of September 10, 2025

Audience: importers, wholesalers, regional dealers, rental-fleet operators

Purpose: Help decision-makers interpret market signals and understand why sourcing PSD Heavy Industries loaders through MUWON USA offers a competitive edge.

Executive Takeaways

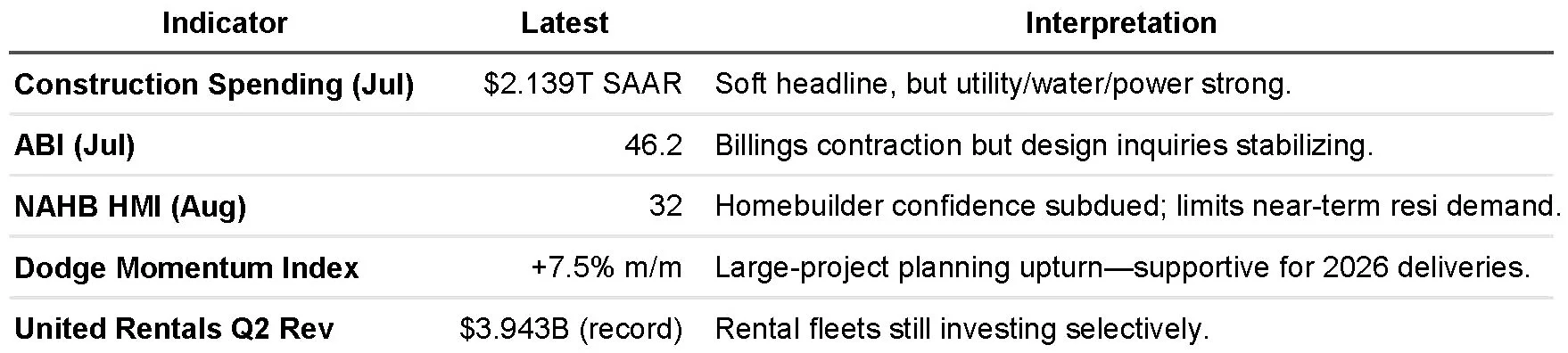

Demand is investable but selective. July construction spending came in at $2.139T SAAR (-0.1% m/m, -2.8% y/y), with pockets of strength in utilities, power, and water driving steady compact-equipment demand.

Forward pipeline strengthening. Architecture Billings Index (ABI) stayed below 50 (46.2), yet Dodge Momentum Index jumped +7.5% m/m—supporting a cautious but improving outlook for late-2025/2026 starts.

Rental channel resilient. United Rentals Q2 2025 delivered record $3.943B revenue and raised guidance, signaling fleets still refresh high-utilization equipment like skid steers.

Freight rates supportive. Drewry WCI at ≈$2,104/FEU (Sep 4) and Freightos FBX near $1,700/FEU USWC provide a predictable cost base. Use a 10–15% buffer for GRIs/blank sailings.

Regulatory clarity. EPA authorized CARB’s amended In-Use Off-Road Diesel rule (Jan 10, 2025), making Tier 4 engines and fleet reporting mandatory for CA deployment.

Import Duty & Compliance – A Careful Approach

While skid-steer loaders generally fall under HTS 8429.51 (Front-End Shovel Loaders), which currently carries an MFN (Most-Favored Nation) duty rate of “Free”, this does not automatically guarantee 0% duty in every case:

Exact classification matters. Subheading (10-digit HTS) depends on configuration (wheel vs. track, engine power, bucket capacity).

Broker confirmation recommended. Engage a customs broker for a binding ruling or classification memo before quoting DDP.

Check for special tariffs. MFN “Free” assumes no Chapter 99 tariffs (e.g., Section 301, safeguard duties). Korean origin currently avoids these, but policy risk remains.

Verify at shipment. Always re-check the USITC HTS Online schedule just before booking to confirm the current duty rate.

This ensures that MUWON USA’s landed-cost projections remain conservative and no unpleasant surprises appear at customs clearance.

Market Drivers & Indicators

Labor & macro crosswinds to price in

The August jobs report showed +22k payrolls, unemployment 4.3%, and—critically—BLS’ preliminary benchmarking points to a large downward revision to prior payroll gains, implying a cooler backdrop for discretionary capex. Expect tighter bid discipline and more demo-to-purchase pathways.

Why PSD PSL-Series Makes Sense

Competitive total cost: With MFN likely duty-free (pending final confirmation) and currently moderate ocean freight, PSL190D can land at an attractive DDP while preserving margin.

Spec coverage: 2,000-lb ROC class hits the sweet spot for jobsite versatility. Smaller models (PSL150D/160D/180D) provide price-sensitive options.

Lead time: ~3 months from PO (production + shipment + delivery), aligning with bidding cycles and 2026 project pipeline.

Action Plan (Next 90 Days)

Quote conservatively: Assume 0% duty but include a footnote “subject to HTS verification” to avoid customer disputes.

Pre-position inventory near metros with rising planning activity (per DMI).

Bundle attachments (forks, bucket, broom) to boost utilization.

Provide compliance packet upfront for California buyers (EPA/CARB engine certificate, fleet reporting checklist).

Use market comps (Ritchie Bros., URI metrics) to set trade-in values and resale expectations.

Key Takeaway for Buyers

MUWON USA can deliver Tier-4-compliant, attachment-ready loaders with a predictable landed cost structure—while maintaining price competitiveness against legacy brands. The timing, freight environment, and pipeline indicators make Q4 2025 a rational window to secure supply ahead of 2026 demand.

Contact

For destination-specific pricing (freight, duties, inland) or spec sheets across PSL150D/160D/180D/190D, contact MUWON USA — muwon@muwon-usa.com | +1-415-727-5133.

Source notes (release dates)

Monthly Construction Spending (July 2025) — U.S. Census release Sep 2, 2025.

NAHB Housing Market Index (Aug 2025) — NAHB release Aug 18, 2025.

AIA/Deltek ABI (July 2025) — AIA/USGlass coverage Aug 20–28, 2025.

Dodge Momentum Index — June/July 2025 updates Jul 8–Aug 7, 2025.

United Rentals Q2 2025 — company press release Jul 23, 2025.

Freight benchmarks — Drewry WCI (week of Sep 4, 2025); supporting trade-press coverage.

Labor backdrop — Reuters on Aug 2025 employment; BLS benchmark revision coverage (Sep 9–10, 2025).

CARB Off-Road – EPA authorization — Federal Register, Jan 10, 2025 decision + document.

HTS 8429.51 — USITC HTS search and duty status references. (Broker confirmation still required for your exact spec.)

Glossary of Terms

SAAR (Seasonally Adjusted Annual Rate)

A statistical adjustment that removes seasonal patterns from monthly data and expresses it as an annualized figure. It shows what annual spending would look like if a given month’s pace continued for 12 months.ABI (Architecture Billings Index)

A monthly leading indicator published by the American Institute of Architects (AIA) and Deltek. It tracks billings at architecture firms to signal demand for design services, which typically leads nonresidential construction activity by 9–12 months. Readings above 50 indicate growth; below 50 indicate contraction.EPA (Environmental Protection Agency)

The U.S. federal agency tasked with environmental protection, including regulation of emissions standards for off-road diesel engines and construction equipment.CARB (California Air Resources Board)

A state-level agency in California responsible for air quality and emissions regulations. CARB often sets stricter standards than the federal EPA; for enforcement, EPA must grant authorization. Relevant here is CARB’s In-Use Off-Road Diesel Regulation, which governs fleet emissions compliance.NAHB (National Association of Home Builders)

A U.S. trade association representing residential builders. It publishes the Housing Market Index (HMI), a widely watched measure of home builder sentiment.HMI (Housing Market Index)

A survey-based index from NAHB/Wells Fargo gauging homebuilder confidence in single-family housing. Values above 50 reflect positive sentiment; below 50 reflect negative sentiment.URI (United Rentals, Inc.)

The largest construction and industrial equipment rental company in North America. Its quarterly financial results and utilization metrics are treated as bellwethers for rental equipment demand.MFN (Most-Favored Nation)

A trade policy principle under the World Trade Organization. For U.S. tariffs, the MFN rate is the standard import duty applied to WTO members unless special duties (antidumping, Section 301, etc.) apply. For HTS 8429.51 (skid-steer loaders), the MFN duty rate is currently “Free.”HTS (Harmonized Tariff Schedule)

The U.S. tariff classification system, based on the global Harmonized System (HS). Every import is assigned a 10-digit HTS code, which determines applicable duties and trade programs.DMI (Dodge Momentum Index)

A proprietary indicator from Dodge Construction Network that tracks nonresidential building projects entering planning. It is a forward-looking signal of future construction starts, typically 12 months ahead.