Market Outlook & Buying Strategy

Week 39 — September 22, 2025

Audience & Purpose

Audience:

This report is prepared for container wholesalers, retailers, portable storage providers, freight forwarders, exporters, traders, and end users who rely on market signals to plan procurement and inventory strategy.

Purpose:

To deliver fact-checked, data-driven insights on container supply, freight rates, and macroeconomic conditions, helping partners make timely, well-informed buying decisions and capture cost advantages through Muwon USA.

Executive Summary

The Federal Reserve’s 25-basis-point rate cut has eased financial conditions, lowering the cost of holding inventory. Container production remains robust, and raw material prices—particularly Corten and mild steel—have fallen further, putting downward pressure on newbuild container prices.

Spot freight rates remain soft, with Asia–Europe lanes under significant pressure and Trans-Pacific rates showing only modest support. This environment strongly favors buyers: now is the right time to secure used equipment and selectively order newbuilds where lead times matter.

Global & U.S. Economic Context

Monetary Policy: Fed funds rate lowered to 4.00–4.25%, signaling continued support for growth. Working capital financing has become more affordable.

Macro Indicators: U.S. manufacturing PMI >53 shows mild expansion, PPI eased (−0.1% m/m), and global PMI remains above 50. Consumer demand is steady but cautious.

Trade Flows: August U.S. imports totaled 2.52M TEU (+1.6% YoY, −3.9% MoM). China’s share dropped to 35% (−10.8% YoY), confirming continued sourcing diversification toward ASEAN suppliers.

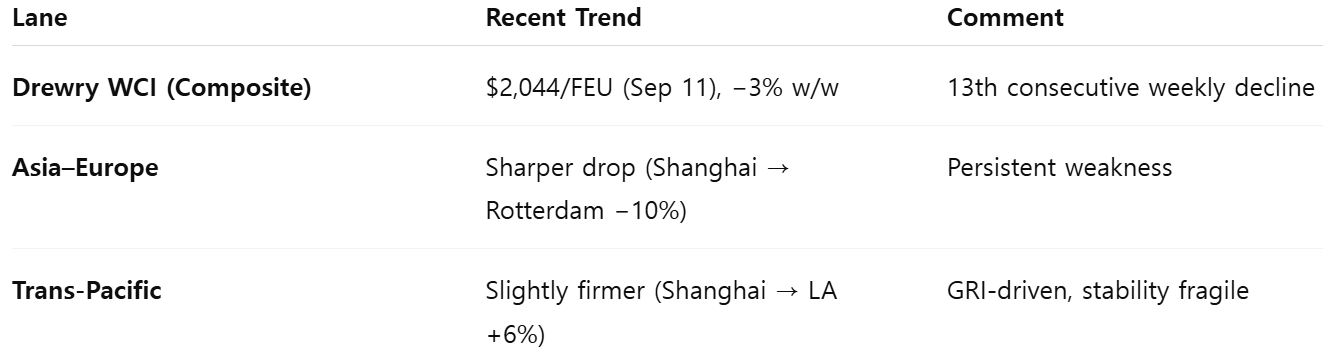

Freight Market Update

Implication: The rate environment confirms a buyer’s market. Current price levels are attractive for locking in supply.

Supply & Production Insights

Newbuild Output: Nearly 50,000 TEU of 20GP and 48,000 TEU of 40HC produced Jan–Aug 2025 — strong supply levels keep upward price risk contained.

Material Costs:

Corten Steel: 5,450 RMB/ton (Jun) → 4,950 RMB/ton (Sep)

Mild Steel: 4,600 RMB/ton (Jun) → 3,930 RMB/ton (Sep)

→ Production cost declines create additional room for price concessions and competitive procurement.

Buying Strategy (Week 39)

Secure Used Inventory: Build 2–4 weeks of buffer stock while prices remain favorable.

Selective Newbuild Orders: Commit only where lead times are critical. Consider waiting until after Golden Week for discretionary purchases to capture further potential price drops.

Negotiate Terms: Use falling raw material costs as leverage to secure better pricing, long-term supply agreements, and lease terms.

Customer Messaging: Promote lower landed cost resulting from soft freight rates and cheaper financing as a reason to act now.

Key Takeaways

Financial conditions have turned buyer-friendly.

Freight rates are near multi-month lows, presenting attractive procurement opportunities.

Material cost declines reinforce downward pressure on newbuild prices.

Acting now secures inventory at a lower cost base and strengthens Q4 readiness.

References

Drewry World Container Index, Sep 11 & Sep 18, 2025

Descartes Global Shipping Report, Sep 9, 2025

Reuters, CBS News – Fed Cuts Rates by 25bp, Sep 17, 2025

Internal Production & Material Cost Data, Jan–Aug 2025

Inventory as of September 21, 2025