Market Outlook & Buying Strategy

Executive Summary

Global freight rates continue to ease across major East–West routes, yet the U.S. domestic container market remains regionally uneven. West Coast gateway markets show persistent tightness, while inland pricing signals moderate conditions. We recommend targeted procurement in coastal premium markets and disciplined, data-driven purchasing inland.

I. Recommendation

Prioritize procurement in U.S. gateway regions—particularly for 40HC and one-trip units—where availability remains constrained and demand resilient. Inland purchases should be selective, scaling only when freight-rate and PMI indicators validate demand strength.

II. Market Summary

A. North America Market Overview

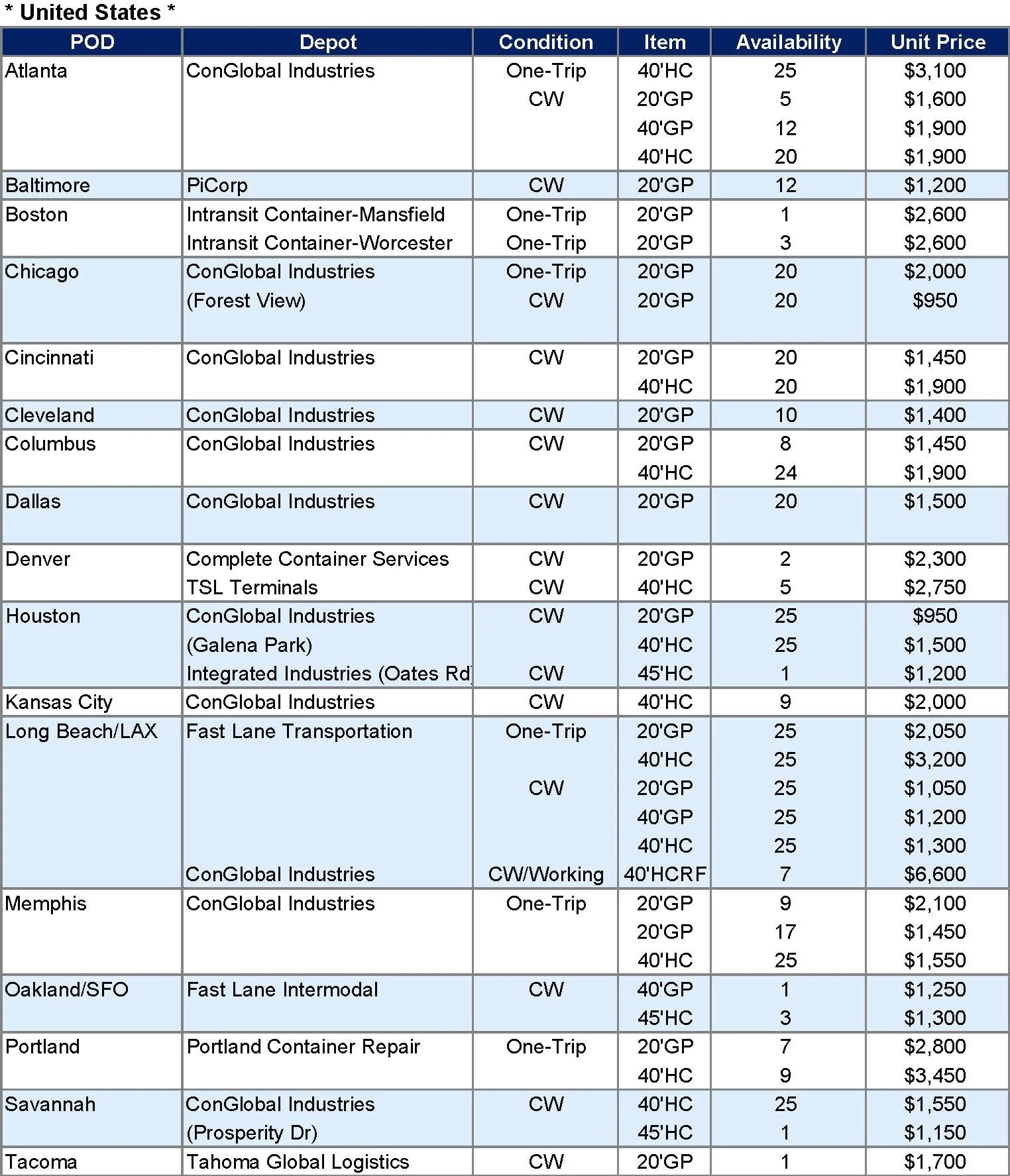

The U.S. container sales market shows a widening spread between gateway and inland regions:

- West Coast: Tightness persists due to elevated repositioning cost, retail inbound flow, and drayage-side constraints.

- East Coast & Gulf: Balanced conditions with stable availability.

- Midwest & Interior: Generally steady, though occasional localized scarcity appears depending on equipment repositioning cycles.

B. Global Freight-Rate Conditions

According to the latest Drewry World Container Index (WCI):

- Composite Index: USD 1,852 per 40-ft

- Shanghai → New York: USD 2,922

- Shanghai → Los Angeles: USD 2,172

These declines reflect easing vessel utilization, higher capacity availability, and normalization post-peak season.

C. U.S. Economic Indicators

- U.S. Manufacturing PMI (Nov): 51.9

- U.S. Composite PMI (Nov): 54.8

Manufacturing shows mild deceleration, while broader economic activity remains expansionary. This supports storage and retail-driven container demand but tempers expectations of aggressive market tightening.

D. Week-on-Week Market Behaviour

- Freight softness reduces urgency for buyers in inland markets.

- Gateway depots continue to command premiums due to access constraints.

- Seasonal drivers (holiday inbound flow, early Lunar New Year planning) provide near-term support for procurement.

III. Analytical Insights

Insight 1 — Local Scarcity Takes Priority Over Global Trend

Even as global freight rates soften, West Coast gateway markets remain tight due to structural constraints including drayage bottlenecks, port flow concentration, and slow empty evacuation cycles. This sustains elevated pricing for premium units.

Insight 2 — Macroeconomic Stability with Caution

PMI trends suggest stable but not accelerating economic activity. Demand for storage and secondary-market containers remains intact but may flatten if freight softness persists.

Insight 3 — Seasonal and Geopolitical Effects

Lunar New Year inventory staging and ongoing global uncertainty (capacity discipline, blank sailings, geopolitical risk) reinforce short-term premiums in select markets, especially for 40-foot units.

IV. Outlook & Strategic Guidance

Short-Term Outlook (4–6 Weeks)

- West Coast: Continued tightness and resilient pricing.

- Inland: Stable-to-soft conditions likely.

- One-trip units: Strong near-term pricing; possible plateau after Lunar New Year.

Price Direction (by Type)

- 20GP CW: Stable or slightly softer inland.

- 40GP / 40HC CW: Firm in gateway regions; flexible inland.

- One-Trip Units: Maintaining premium positioning in major coastal hubs.

Strategic Procurement Position

- Secure coastal premium units early.

- For inland procurement, scale gradually and avoid bulk commitments until freight-rate stabilization.

- Monitor WCI, U.S. PMI, and port congestion indicators weekly.

Final Recommendation

Take advantage of early procurement opportunities in gateway markets while maintaining disciplined purchasing inland. Freight softening offers timing leverage, but regional scarcity—especially along the West Coast—supports immediate action for high-demand units.